Economical

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

Simple home-based solutions quickly. Funds transferred immediately with flexible loan durations

Apply conveniently via our app with a straightforward form.

Be on the lookout for our fast decision within 15 minutes.

Have the money transferred to you, usually within one minute.

Apply conveniently via our app with a straightforward form.

Download loan app

Instant loans have become a popular financial option in Nigeria, offering quick access to funds for individuals in need of immediate cash. These loans are designed to provide a convenient solution for short-term financial needs, offering various benefits and practical uses for borrowers.

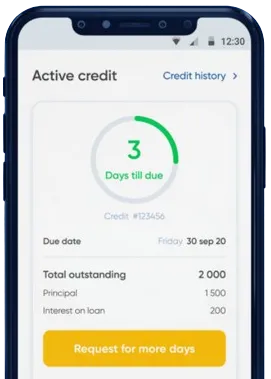

One of the key benefits of instant loan in Nigeria is the speed at which funds can be accessed. With online platforms and mobile applications, borrowers can apply for a loan and receive approval within minutes, allowing them to address urgent financial needs promptly.

Additionally, instant loan require minimal documentation and have simple application processes, making them accessible to a wide range of individuals, including those without a strong credit history. This ease of access makes instant loan a convenient option for emergency situations or unexpected expenses.

Furthermore, instant loan in Nigeria often come with flexible repayment options, allowing borrowers to choose a repayment schedule that suits their financial situation. This flexibility can help borrowers manage their finances effectively and avoid falling into a cycle of debt.

Instant loans can be a valuable tool for individuals facing a temporary cash crunch or unexpected expenses. Whether it's covering medical bills, car repairs, or other emergency costs, instant loan provide a quick and convenient way to access funds when needed.

Moreover, instant loan can also be used for investment opportunities, such as starting a small business or pursuing further education. By leveraging instant loan, individuals can seize opportunities that may not have been possible without access to immediate funding.

When looking for an instant loan in Nigeria, it's essential to consider factors such as interest rates, repayment terms, and the reputation of the lending institution. Comparing loan offers from different providers can help borrowers find the best terms and conditions that align with their financial goals.

Instant loans in Nigeria offer a range of benefits and practical uses for individuals in need of quick access to funds. By providing a convenient and flexible financial solution, instant loan can help borrowers effectively manage emergency expenses, seize investment opportunities, and navigate temporary cash shortages.

An instant loan is a type of loan that provides quick access to funds, usually within a few hours or days of application.

Most lenders in Nigeria offer online application processes for instant loan. You can visit their website, fill out the application form, and submit the required documents to apply.

The requirements for getting an instant loan in Nigeria may vary among lenders, but commonly required documents include a valid ID, proof of income, bank statements, and a utility bill.

Yes, some lenders in Nigeria offer instant loan to individuals with bad credit. However, the interest rate may be higher, and the loan amount may be limited.

Once your loan application is approved, you can typically receive the funds in your bank account within 24 hours.

If you miss a repayment on your instant loan, you may incur late fees or penalties. It can also negatively impact your credit score and make it difficult to borrow money in the future.

Some lenders may charge hidden fees such as processing fees, late payment fees, or prepayment penalties. It is essential to read the loan agreement carefully and ask the lender about any additional fees before borrowing.